When we model this preferred equity structure, we first need to consider the joint venture. The joint venture is the genesis of the cash flows, after which the preferred and common will split their share accordingly. So what does this joint venture look like? Pay close attention – cash flow modeling is one of the core real estate private equity skills.

Describe the Unlevered Cash Flows

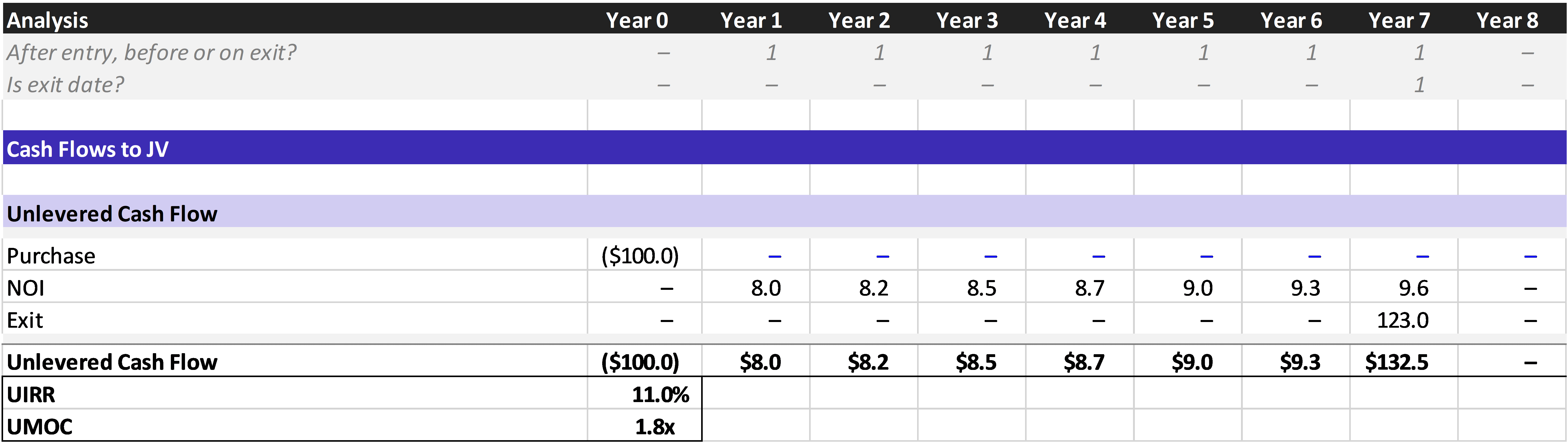

First, the unlevered cash flows. Well, you’re going to buy a building for $100. That building will give you an initial NOI of $8.0 in T1, growing 3.0% per annum thereafter. We assume the hold period is seven years, after which we sell the building at an 8.0% exit cap rate. That’s a lot of words, how does it actually appear in a model?

Unlevered Cash Flows in Excel

Describe the Levered Cash Flows

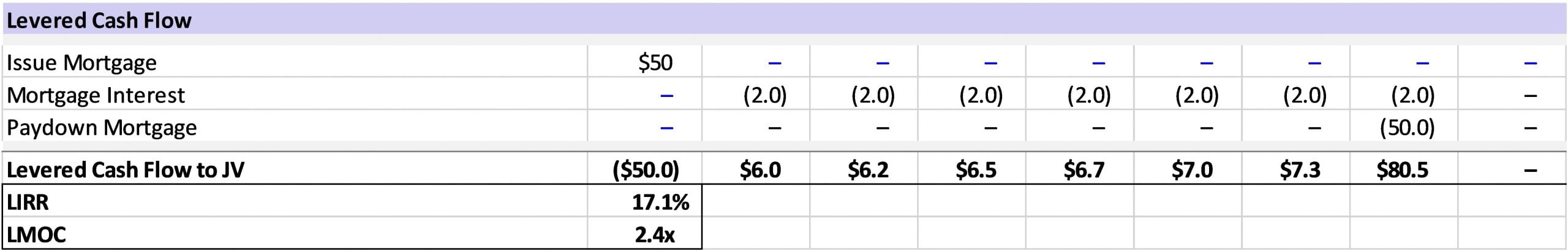

Next up, we have the levered cash flows. So the joint venture entity will purchase the building for $100. It will finance this building with 4.0% fixed debt at a 50% LTV. That’s all we need to know to get cracking, so let’s peek into our Excel model. Note – that total line Levered Cash Flow to JV also sums in the unlevered cash flows.

Levered Cash Flows in Excel

Interested in my Backup?

Obviously I didn’t just type those cash flows directly into Excel as hardcodes. If you’re interested, you can download my backup by clicking the link at the bottom of this article. There, you’ll see the most headache-free way to control growth rates, exit cap rates, hold periods, and much more. But if you wish, the images herein should give you enough to teach yourself these critical real estate private equity skills.

Why did we start with the Joint Venture Entity?

If we were modeling the debt, we would only care about the property. We don’t care about who comes after us, so long as we get paid our due. Yet because we are modeling an acquisition of the preferred equity, we care about more than just the property. Before we model the preferred equity, we have to understand what income the property generates and what interest the debt before us collects. We are only ready to model the preferred structure after we understand the entire JV entity, which we do now.

We can’t create money out of thin air

At the end of the day, we’re just going to split these JV cash flows between the pref and the common. That initial $50 outflow will be funded by the preferred equity and the common equity. The remaining $120.3 of profit after interest will also be split between the preferred and common equity. So when we finish our model, the most critical check is to see that our cash flows to common and preferred match our joint venture cash flows. Keep this in mind for real estate private equity interviews – your cash flows to debt, preferred, and common must always tie to your unlevered cash flows. After all, the entire exercise is just figuring out how the cash comes in and where the cash goes out after the property throws it off.

A Note on Subordination

Quick challenge! Who will have the higher return? I said quick – it should be obvious that the common equity will have the highest return. They take the most risk! The common equity cash flow is subordinated to the preferred equity. In the same way the fixed debt earns a lower 4.0% coupon because it is less risky, the preferred will also earn a lower return than the common. Keep an eye on this word subordination, it is key in real estate private equity interviews. Subordination just describes the order in which cash flows from one stakeholder to the next.