Introduction

The previous post answered the first question of the prompt, “what are the gross returns of this investment?” by building a simple real estate LBO model. This post will begin our journey to answer the second question of this REPE case study, “what net return should the LP expect to earn?” Of course, net return just means gross return less the fee the LP (pension fund investor) pays to the GP (our REPE fund). The waterfall is just the thing that calculates that fee. So let’s build it!

Distinguish the Deal from the Waterfall

Step one, let’s create a clear distinction in our real estate LBO model between the underlying deal and the waterfall overlay. The idea here is that the deal feeds the waterfall. Like I said in the first post, a waterfall just takes the cash flows.

So really, we are building two separate machines in this REPE case study. If we think black box input-output, the first machine takes assumptions for a real estate investment and outputs cash flows. The second machine takes any cash flows and outputs a fee calculation. You could reuse this waterfall for any sort of investment, we just happen to be running it for a real estate transaction.

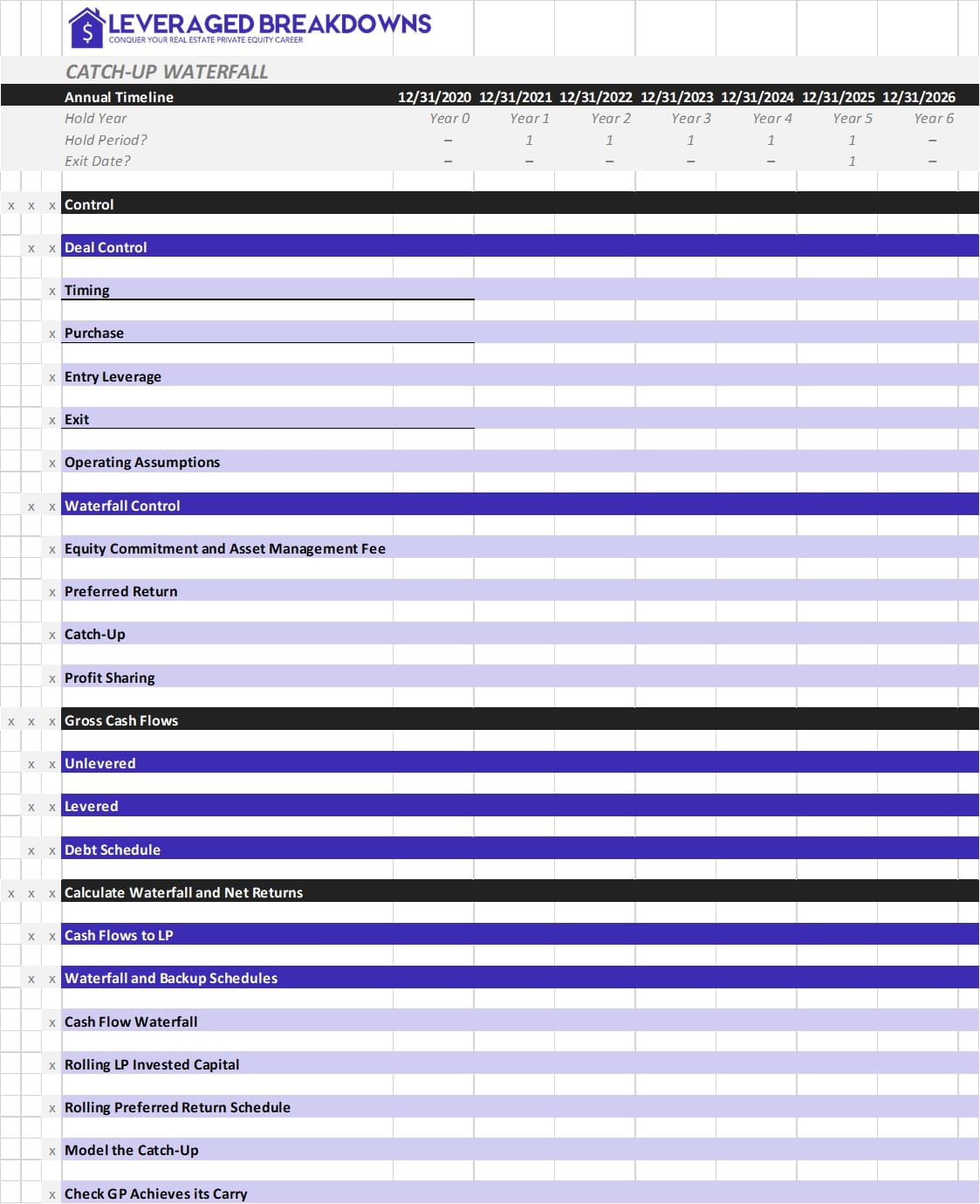

So in the control section, let’s just create two header sections that separate the controls for the deal and the controls for the waterfall. This just makes our model easier to read and use, which is the end goal anyways. Also, go down under the cash flows area and create a separate heading for the Waterfall. Your end result will look something like this (content collapsed, headers shown illustratively):

Input the Waterfall Control Variables

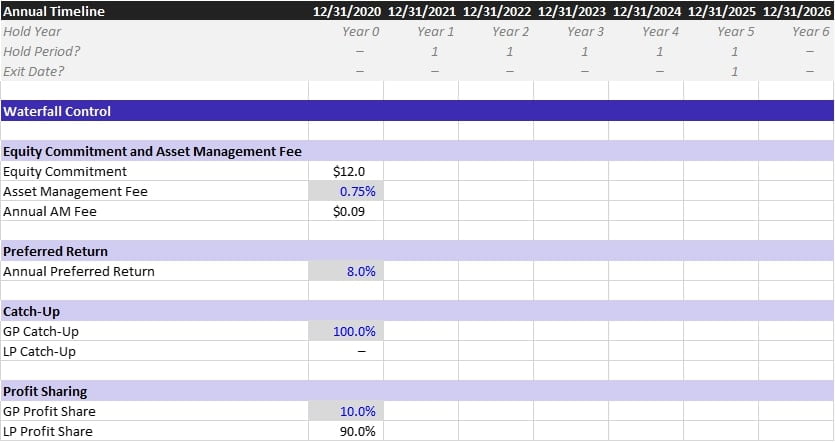

Now that our structure is established, let’s finish the waterfall control section. Per the prompt, we want to model a 10% carry over an 8% hurdle with 100% catch-up and a 75bps asset management fee. But what does that really mean? REPE funds often speak about waterfalls in the most reduced form possible, which can be confusing to outsiders. Fortunately, they follow similar patterns.

For a catch-up waterfall, a more linear way to read the prompt for question two is this:

- All cash flow will go to the LP until they achieve an 8% preferred return

- Then, the GP will receive a 100% catch-up and the LP will receive a 0% catch-up (FYI if the GP received a 60%, the LP would get a 40% – it always totals 100%)

- Finally, the remaining profit is split 90/10 to the LP/GP.

We will dive into specifics if anything above is confusing. For now, just input those as your waterfall control variables, as I have below.

Build waterfall

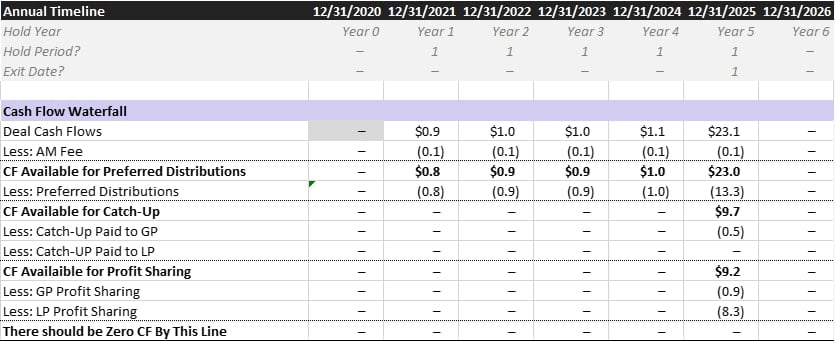

Our waterfall will follow the sequence of events, detailed below. Each step takes a set of cash flows, does something to it, then passes the altered set of cash flows to the proceeding step until the waterfall finishes. As you’ll see below, I like to build the waterfall all together so it’s clear where all cash is going.

- Gross Deal Cash Flows: Our waterfall begins with the gross deal cash flows

- Asset Management Fee: We then subtract the asset management fee, which is the $12M invested equity times the 75bps AM fee

- Preferred Distributions: The LP receives all distributions until they achieve an 8% return. We’ll build an equity schedule that concisely handles this logic for us. The logic will be similar to the Cash-or-PIK coupon we build in the preferred note case study, with the distinction that the GP gets nothing until the LP achieves an 8%

- Catch-Up: Once the LP achieves its preferred return, the GP gets “caught-up” by taking 100% of the cash flows until they receive enough cash so that by the end of the next profit sharing step, they will have received 10% of the total deal profit

- Profit Sharing: Finally, the GP receives 10% of the post-catch-up cash flows. This line works in tandem with the catch-up to solve for the GP receiving exactly 10% of the total deal profit after the asset management fee

In the next post, we will begin building the mechanics for each step of the waterfall. But immediately below is how the waterfall will appear once we have finished. Perhaps you can give this a try right now and see how you stack up!