Introduction

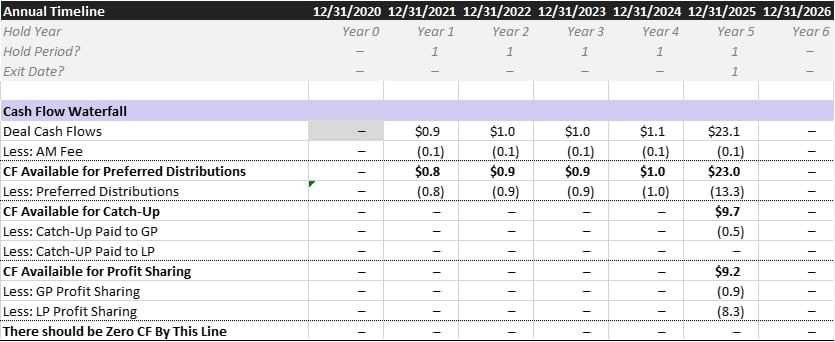

The previous post described our calculation of the asset management fee and the preferred distributions. This post will focus on our calculation of the catch-up and the profit sharing. Then, we will tie it all together with a concise summary of the LP cash flows. Below is the overview of the waterfall we shared in the second post of this series. After this post, you will understand how to calculate each line in this waterfall.

Catch-Up

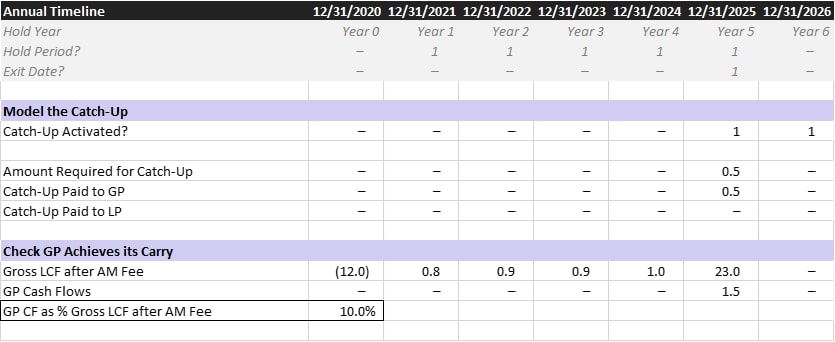

We are approaching the end of our catch-up waterfall. This second-to-last piece, the catch-up, works in tandem with the profit sharing mechanism that we will describe last. The end goal is to ensure that the GP earns 10% of the total profit that the LP has earned above their initial capital contribution. The steps below describe each row in the catch-up schedule, copied further below.

- Catch-Up Activated?: The catch-up happens the moment the LP achieves their preferred return. The LP achieves their preferred return once the ending balance in the preferred schedule hits zero. So let’s just build some activation logic that flags a one once the preferred balance hits zero

- Amount Required for Catch-Up: This line calculates the total amount of cash flow required for the catch-up. After the catch-up tier and the profit tier of the waterfall, the GP should receive 10% of the total profit that the LP has earned

- Catch-Up Paid to GP: Because this is a 100% catch-up, 100% of the amount required for catch-up goes to the GP

- Catch-Up Paid to LP: On the flip side, this 100% catch-up means that the LP receives 0% of the catch-up proceeds. So the LP line is zero in this example

Profit Sharing

The profit sharing step is easy. Once you have paid the catch-up, the remaining proceeds are split 90/10 to the LP/GP. I don’t build a backup schedule for this, I just put it right into the cash flow waterfall schedule itself (see very top of this post). Once you’ve built the profit sharing, we have finished the waterfall! Now we just need to tie it all together with a concise set of cash flows before we can answer the second question of the prompt on LP net return.

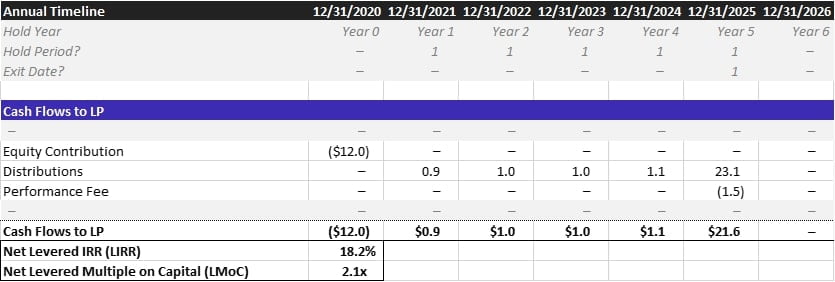

Concisely Presenting the LP Cash Flows

We should concisely present the cash flows in a manner that makes sense to the LP. They’re trusting us (the REPE fund / GP) with their capital, so our business plan should clearly show how their capital will make its way back and what fees we charge for our management. The below should be self-explanatory and is how I would recommend showing the investment to the LP. Also, it answers part two of the initial prompt: what net return should the LP expect to earn? The answer is the LP should expect an 18.2% Net LIRR and a 2.1x Net LMoC.

Familiarize Yourself with the Catch-Up

Once finished, you should play around with the catch-up logic to familiarize yourself with its mechanics. If you set the catch-up to 50/50 GP/LP, you’ll see that the catch-up required for the GP to earn 10% of the total profit increases versus the 100/0 GP/LP scenario. And if you turn the catch-up to 0/100, you’ll see that the GP only earns 10% of the profit above the preferred return threshold.

The Leveraged Breakdowns Advantage

We strive to create the best real estate private equity course to level the interview playing field. Industry outsiders face enough obstacles breaking into this exclusive industry. Access to high-quality information should be available to everyone, not just to friends and family of insiders. If you’re looking to get a leg up, check out our real estate private equity career development courses and technical interview guide.