Introduction

The last blog covered the 1:1 spin-off of AIR from AIV, and the blog before that spoke to creating a dummy NAV build. This blog will attack the first half of the NAV equation – calculating gross asset value. To begin, we’ll model AIV as the pre-spin company. Once we’ve established our pre-spin NAV, we can shift focus to bifurcating NAV between the AIR NewCo and the AIV LegacyCo. Keep in mind, this sort of modeling is likely to appear in the case study round of the real estate private equity interview process. If you’re looking for the best real estate private equity course for first-round interviews, check out our starter kit and technical guides.

Home Base: The AIV 2Q20 Balance Sheet

Let’s cut to the balance sheet, which you’ll find front-and-center on pdf4/doc3 of the AIV 2Q20 10Q. It looks like this, and provides a finite summary of most things we’ll want to pick apart for our NAV build:

Quick Pro Tips on Pulling and Reading Financial Reports

First, most financial reports are presented in thousands of dollars. So when I bring the balance sheet items into my NAV schedule, I’ll keep in mind to divide all the data by 10^3 so that my information is presented in millions. Whenever you bring in data, always make it clear on your outputs what form the dollars presented take place, whether they’re in thousands, millions, billions, etc.

And a quick FYI in case you’re looking at my Excel backup. I use a service called BamSEC to quickly pull Excel schedules of Aimco’s filings. For instance, I downloaded the 2Q20 Balance Sheet from the 10Q as an Excel file with this link. BamSEC is great if you can afford the price since it saves time and reduces fat-finger data entry errors. But assuming you aren’t willing to spend the requisite $29/mo on this niche service, you can also just manually enter the data – just check it twice for accuracy!

Finished Product

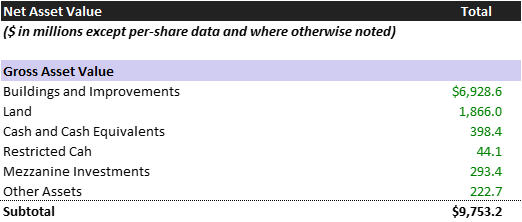

Now, let’s work our way down the balance sheet to grab what is relevant for our NAV build. But first, here’s how the finished product of the GAV section will appear:

Buildings and Improvements ($6.9B)

Aimco bifurcates the value of its properties between the value of the underlying land and the value of the physical structures on top of the land. This $6.9B represents the book value of the buildings, exclusive of the land value. Another word for buildings is improvements – they’re the same concept, improvements just means all the physical things you build to improve the land beyond its natural state as a pile of dirt.

Land ($1.9B)

This is the value of the dirt underneath the improvements. A key accounting difference between land and improvements is that land never depreciates, whereas the value attributed to the building (aka the improvements) depreciates over time.

Cash and Cash Equivalents ($0.4B)

REITs like Aimco do not keep much cash on their balance sheet since they are required to distribute at least 90% of their taxable earnings as dividends. For what cash they do keep on their books, it’s incredibly easy to value since their book value is effectively their bank account balance. And Restricted Cash ($0.04B) is just cash that has been earmarked for specific projects. For our analysis, it’s effectively the same as cash.

Mezzanine Investments ($0.3B)

This is an AIV-specific item. This line represents the value of a loan that Aimco extended on November 26, 2019 to the partnership owning Parkmerced Apartments (Google it!). The loan accrues 10% per annum and matures in November 26, 2024 with a five-year extension option into 2029. Aimco also retains a ten-year option (expiring November 26, 2029) to acquire a 30% interest in the partnership at a $1.0M exercise price. We’ll dive into the nuanced valuation of this particular loan and purchase option in a bit. But high-level, it seems that Aimco made this loan to facilitate the development of a portion of 4,093 new market-rate homes in the otherwise rent-controlled Parkmerced community.

Some additional color: a bit of digging reveals this is a 3,221-apartment home community located on a 1,520 acre site in southwest San Francisco developed by MetLife before and after WWII. All apartments are subject to rent control limited to annual rental rate increases at 50% of CPI for continuing occupancy. However it looks like the loan that Aimco made was to facilitate the development of market-rate units, which are not subject to rent control. This mezzanine investment stands apart from AIV’s other real estate positions since they hold a position slightly more senior than their typical equity stake.

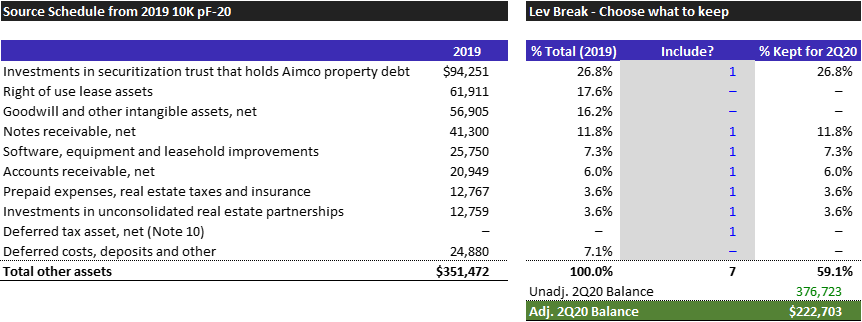

Other Assets ($0.4B before / $0.2B after adjustments)

Unfortunately, the 2Q20 10Q does not readily disclose the individual accounts that comprise the $377M balance of other assets. However, if we look at the 10K page F-20, we can see what comprised the $351M balance at the end of 2019 and assume 2Q20 is relatively similar. So let’s take a gander at what’s in this Other Assets account in 2019, then remove anything that is a non-cash accounting convention. Below is a schedule which does just this, and it looks like 59.1% of the other assets in 12/31/19 were true assets, the rest were accounting plugs. So until we find better information on the 2Q20 other assets, let’s assume a similar composition of 59.1% “true” assets.

Depreciation ($2.8B)

I’m excluding $2.8B of depreciation from this analysis. REPE investors typically exclude the impact of depreciation from their GAVs. The general idea is that depreciation is more of an accounting convention used to manage net income than it is an indicator of fundamental value. You could argue with me, but it’s a bit of a moot point since we’ll ultimately replace these book values with market values.

Conclusion

That’s it for now regarding our gross asset value. Future improvements will be applying market valuations to the individual assets, but we’ll stick with these figures for now. Looking for more? Check out the best real estate private equity courses made by megafund insiders for outsiders. Leveraged Breakdowns has just what you need, whether you have an impending real estate private equity interview process or want to get smart before a job you’ve already accepted.