Real estate private equity case studies often ask you to model cash flow waterfalls. To the uninitiated, waterfalls can seem complex and obscure. But really, waterfalls just determine how investors split the pie when the money comes back around. Pay close attention here, because the skills taught in this post will apply to most every kind of waterfall!

This series focuses on a preferred equity note, but the mechanics are nearly identical to promote-based waterfalls, which we build together in the REPE starter kit. Alright, so the first post framed the question as you would see it in a typical interview. In the second post, we built some quick dummy JV cash flows. In this third post, we model the waterfall that splits the JVCo cash flows between the preferred equity and the common equity.

Taking Stock

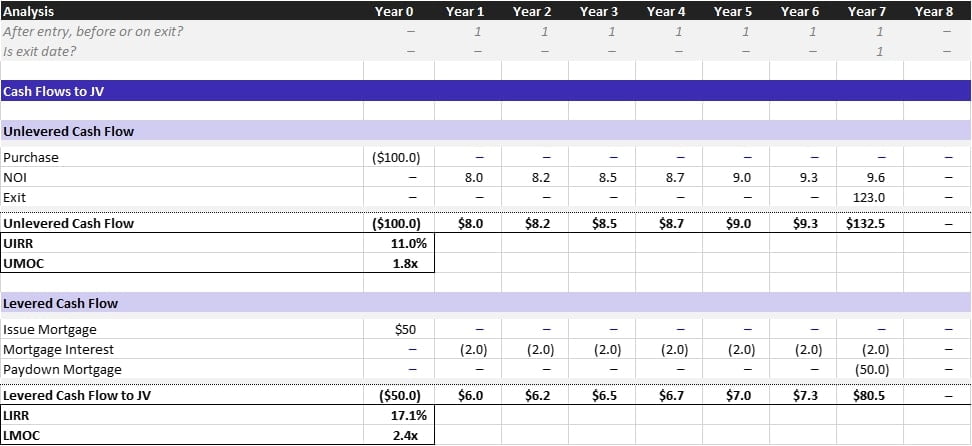

We built the above cash flows in the last post. Now, we just need to figure out how we’ll divide them up. First, that first $50 outflow in T0 will be split equally between the common equity and the preferred equity, per the initial prompt. Second, the interim cash flows (NOI less Interest) will be split according to the rules outlined in the “coupon” and “additional cash flow participation” sections of the prompt. Finally, the terminal cash flows will be split 40/60 in the favor of common equity – this bit is just dividing “exit” less “paydown mortgage.”

Modeling with Backup Schedules

Excel is great because you can always add backup math below your main cash flow output. The more granular you build your backup, the easier your life will be. In this case, we are going to build three supporting schedules that help us determine where cash goes:

- The first will be the hold cash flow waterfall schedule

- The second will be the exit cash flow waterfall schedule

- The third will be the preferred equity schedule

- And the fourth will be the common equity schedule.

The purpose of these schedules is to translate the rules of the preferred and common equity into math. Once built, we will end this real estate investment case study by linking together cash flow projections for the common equity and the preferred equity. This post will cover the first two schedules, the others will be covered in the next post.

The Hold Cash Flow Waterfall

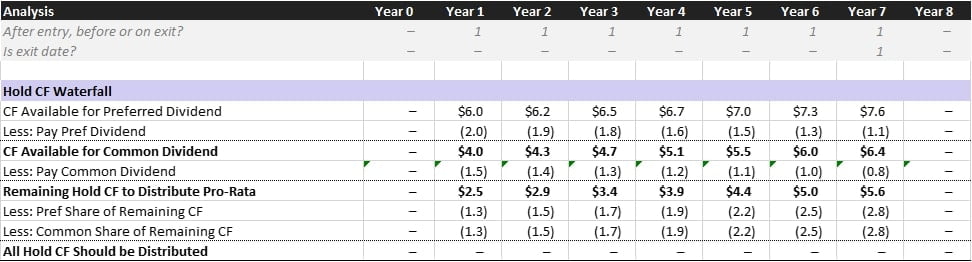

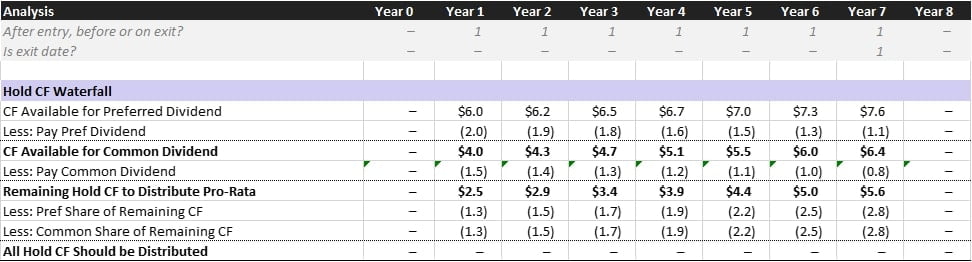

Above is our hold cash flow waterfall, which divides the hold period cash flows (NOI less interest on debt) between the preferred equity and the common equity. The hold cash flow waterfall is split into the following tiers:

- CF Available for Preferred Dividend – The preferred equity gets first dibs on the hold cash flows for its 8.0% PIK coupon

- Less: Pay Preferred Dividend – In this row, we actually pay as much of the 8.0% preferred dividend as possible. Here, we’re able to pay all of it

- CF Available for Common Dividend – The common equity gets second dibs on its 6.0% PIK coupon

- Less: Pay Common Dividend – As with the preferred equity, the common equity receives its entire coupon due in each period

- Remaining Lines – Finally, the preferred and common evenly split anything left over. They split this evenly because they both committed $25M. Further, these additional proceeds pay down the face value of the preferred and common. This interim paydown of principal is why you see the preferred and common coupons slightly declining over the hold period.

Side Note: if it’s confusing for you to think of common equity as having a face value, just pretend I’m saying “junior preferred equity note” instead of “common equity” each time, and the common in this investment would be some negligible amount like $1.

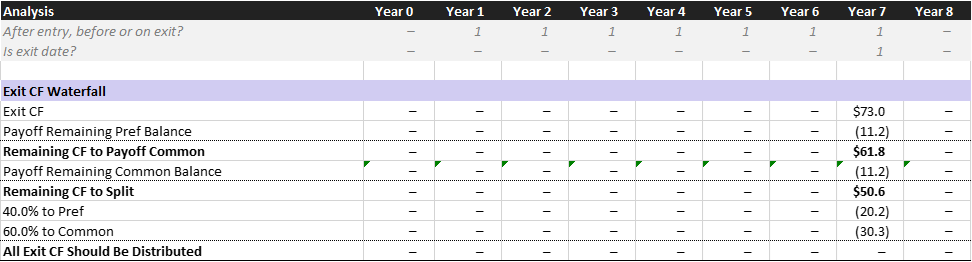

The Exit Cash Flow Waterfall

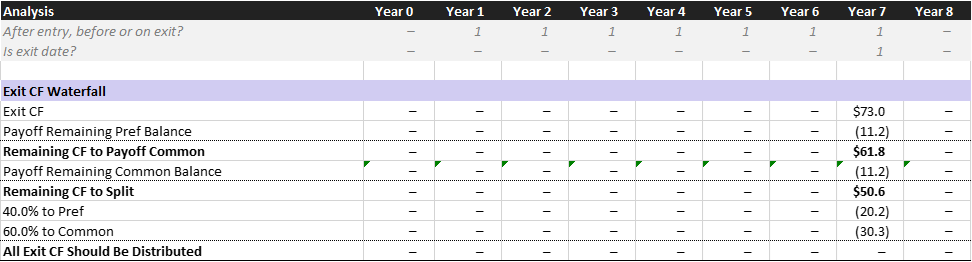

The second waterfall is stipulated in the “exit participation” bullet of this real estate private equity case study’s initial prompt. It’s pretty easy to model:

- Exit CF – At exit, the preferred and common equity will split $73.0M, which is the $123M exit value less the $50M mortgage. You can see the hold cash flows in the second post of this series.

- Payoff Remaining Pref Balance – Before we get divide the exit proceeds, the pref needs to get back all of its initial capital and accrued yet unpaid PIK interest

- Payoff Remaining Common Balance – Now, the common is also due its initial commitment and any unpaid PIK interest

- Remaining CF to Split – Anything left after the above will be split 40/60 in the favor of the common equity. This is an arbitrary split specific to this particular deal as detailed in the case prompt.

Leveraged Breakdowns Has Your Back

Leveraged Breakdowns is maintained by Manhattan megafund investors. After our full-time jobs, we commit nights and weekends to help outsiders understand this complex industry. We do our best to break everything down to the most understandable components, and focus only on the high-impact concepts whose mastery will earn you a career. From our free real estate investment case studies to our premium content, we have your back every step of the way to your full time job offer.