Introduction

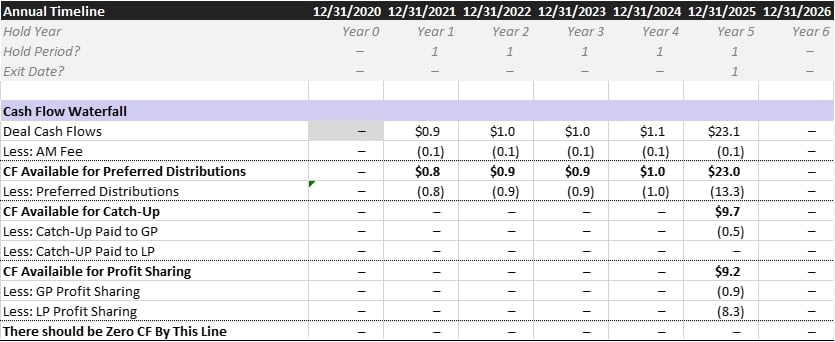

This post is part of a deep dive into catch-up waterfalls, which can show up in the more technical portions of the real estate private equity interview process. Last post, we left off with the waterfall schedule below. This post will dive into the details of the asset management fee and the preferred distributions. Then, we will cover the catch-up and profit sharing mechanisms to fully answer the second question in the case prompt.

Calculating the Asset Management Fee

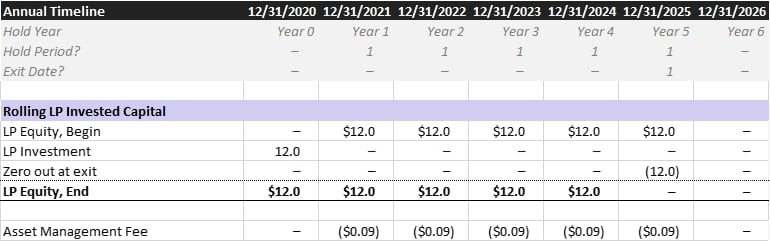

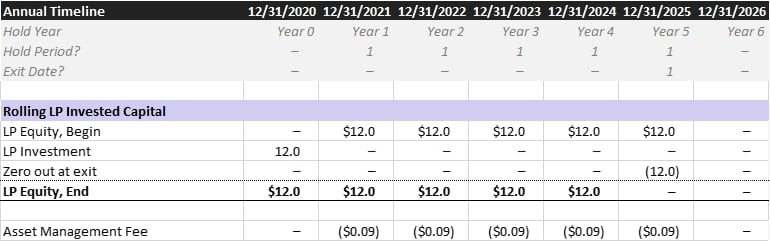

There are numerous ways that GPs and LPs negotiate the asset management fee (AM fee). Two popular methods are by committed capital and by invested capital. For this real estate private equity interview case study, we will calculate the asset management fee on invested capital. This means the GP will charge the LP a recurring fee on the initial equity they contributed until the investment liquidates. The LP will contribute the full $12M equity requirement calculated in the last post, so the annual AM fee will be 0.75% times $12M, or $90k per year.

Below, I built a small schedule with logic that automates the AM fee calculation. Remember to charge the AM fee on beginning equity, not ending equity. Otherwise, you will erroneously charge a fee at T0 and no fee in the final year.

Preferred Distributions

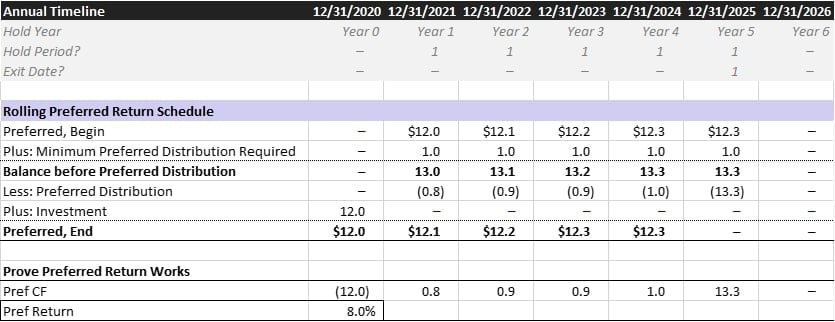

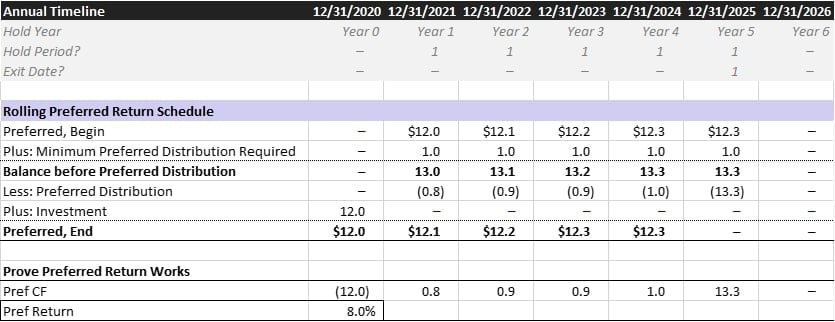

As mentioned above, the LP is due all distributions until they hit an 8% preferred return. The math to drive this logic is simple when we build the schedule below. Working through each line of the preferred return schedule below, the logic hopefully becomes self-evident:

- Preferred, Begin: At the very start, the LP has invested no equity. So we begin with a zero balance. This balance will corkscrew (begin balance of new period = end balance of prior period) until fully repaid

- Plus: Minimum Preferred Distribution Required: This is the most magical line. Each period, you just multiply the beginning balance by 8% and add this required preferred distribution into the equity balance. This is how we guarantee the preferred hits an 8% exactly, since any prior distributions that accrued yet were unpaid compound upon themselves

- Less: Preferred Distribution: All cash flow after AM fees must be used to pay the preferred return. We’re able to pay so much more in the last period because that’s when we sell the asset

- Plus: Investment: This is the last line because we should not calculate a preferred distribution required in the T0 period, which is when we make the investment. But in Y1, we need to show a beginning balance of $12M upon which that initial $96k preferred dividend will accrue

- Preferred, End: Finally, the preferred balance is the sum of the three lines described above. The next period’s Preferred, Begin will reference this Preferred, End. Another name for this style of schedule is a corkscrew, as mentioned earlier.

If you’re still scratching your head, I’ve built a proof below that you can check yourself. If our LP commits $12M up-front, receives the distributions as described with accruals along the way, they will achieve exactly an 8% return.

Learn with Leveraged Breakdowns

Leveraged Breakdowns is here to guide you through the real estate private equity interview process and beyond. We offer hands-on courses and a technical interview guide that share knowledge previously available only to close friends and family of insiders. This particular post is part of our effort to provide free real estate private equity interview case studies to all of our readers. If you wish to support us with a membership, you’ll also get access to the full model download here and in our other free cases.