Introduction

Welcome back to the REPE career development series series focused on building a public valuation model of Aimco. If you’re lost, part one is here. If you want my exact model, scroll down and click the download button; but you’ll need a course membership subscription first. However if you aren’t yet a member, this post has everything you need to build the exact same model on your own.

Update your Financials to 2Q20

Just a reminder that you should update your own data room to the 2Q20 financials for this project, not the now-outdated 1Q20 financials that we began with. You can download the latest 2Q20 financials here. Make sure to grab the latest 2Q20 10Q, 2Q20 ER, and 2Q20 Supp. The 10K, Citi IP, and June 2020 IP are all the same as before, though the financials therein are now more outdated. Thus, we’ll do our best to source from the 2Q20 information as much as possible but might have to fall back on the greater detail provided in the slightly older documents. You’ll often work with limited data throughout your career in REPE; we’ll teach you some tricks as we go along to best deal with limited information.

Equity is Gross Asset Value less Liabilities and Transaction Costs

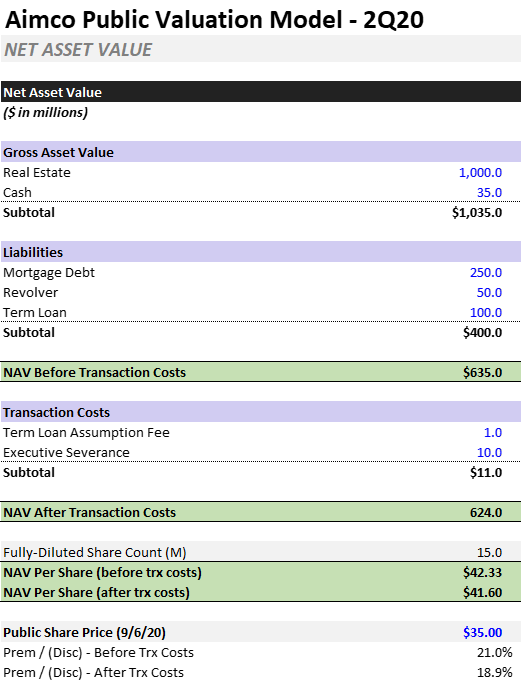

We are underwriting this company from the perspective of a real estate private equity investor. Naturally, we want to understand the value of the company’s equity. To value a company’s equity, we need to understand three things:

- Gross Asset Value (GAV): The sum total of all assets is called the company’s gross asset value or GAV. This company owns a bunch of operating real estate, a few developments, perhaps some empty land, some cash, some working capital accounts, and a few other assets. For now, we’ll pull the book value estimate of gross asset value, but later we will try to derive a more market-based valuation of GAV.

- Liabilities: To calculate the value of our equity position, the net asset value, we must subtract all the liabilities from the GAV. Such liabilities include (but are not limited to): property debt, unsecured corporate revolvers, unsecured corporate term loans, convertible bonds, and preferred equity instruments.

- Transaction Costs: As a general rule across your REPE career, you will underwrite acquisitions to obtain full control. Unlike hedge funds, we do not prefer to take minority stakes via the public float of a company. Instead, if we are going to buy a company, we take the entire thing private. This change of control triggers various transaction costs such as debt assumption or make-whole premiums and executive bonuses and/or severance packages. We will need to estimate these transaction costs and accordingly reduce our equity value to compensate for the drag on value.

High-Level Example NAV

Below is a dummy example of how we will calculate our NAV per share. None of these figures are from Aimco’s filings, I just want you to get a visual taste of the output we’ll soon create with real Aimco data. Make sure you understand the purpose of this dummy NAV build, because in the next post we will begin pulling real numbers into our model from Aimco’s financials.

Insider Mentorship for Outsiders

Leveraged Breakdowns bridges the education gap between insiders and outsiders. If you’re looking to launch your own career in REPE, but don’t know where to begin, look no further. We have spent years consolidating the most relevant information for hungry outsiders eager to break in. No more wasting time on ineffective study guides and interview prep – Leveraged Breakdowns brings you the real deal.